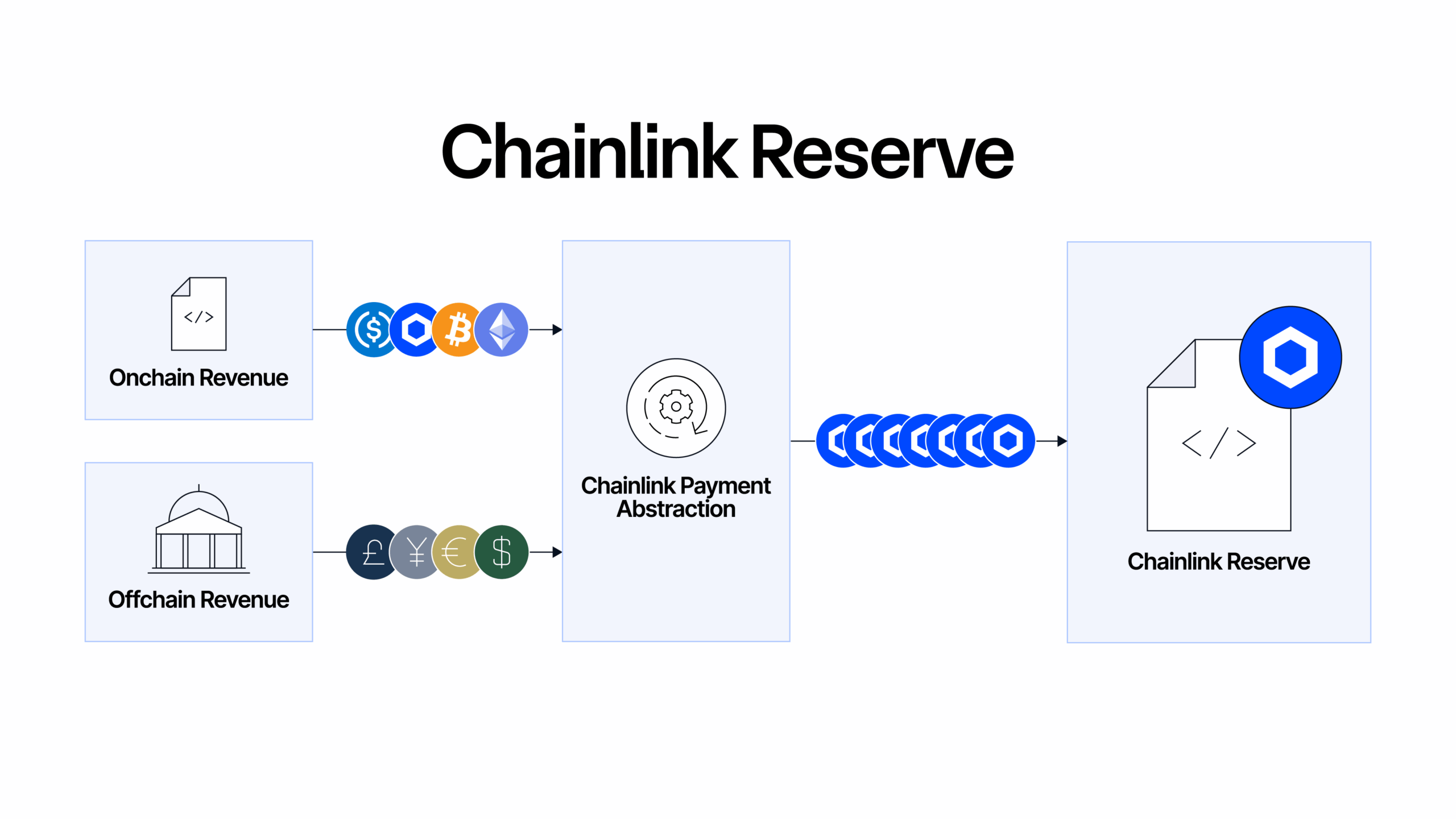

- Chainlink Reserve converts enterprise and onchain revenue into LINK using Payment Abstraction.

- The Reserve supports sustainable growth, DeFi adoption, and enterprise blockchain integration.

- Transparent dashboards and secure timelocks ensure visibility and long-term accumulation.

The blockchain ecosystem is entering a new era of maturity, and Chainlink (LINK) is at the forefront. With the launch of the Chainlink Reserve, the platform is set to create a long-term strategic onchain reserve of LINK tokens, fueling growth, adoption, and sustainability. The initiative, powered by Chainlink’s Payment Abstraction, converts revenue from both enterprise integrations and onchain services into LINK, ensuring a self-reinforcing mechanism to strengthen the network.

This move comes as Chainlink continues to solidify its market leadership in decentralized oracle services, offering critical infrastructure for DeFi, tokenized assets, and enterprise blockchain adoption. The Reserve promises to be a cornerstone in Chainlink’s economic strategy, combining advanced onchain infrastructure, automated processes, and a vision for long-term financial sustainability.

The Chainlink Reserve As a Strategic Economic Upgrade

The Chainlink Reserve is an onchain smart contract designed to accumulate LINK tokens by leveraging both offchain and onchain revenue. Early implementation has already resulted in over $1 million worth of LINK secured in the Reserve. Importantly, withdrawals are not expected for several years, allowing the Reserve to grow steadily alongside enterprise adoption.

The Reserve is built upon Payment Abstraction, which enables users and enterprises to pay for Chainlink services in their preferred form—be it gas tokens, stablecoins, or other assets. These payments are then programmatically converted into LINK using a combination of Chainlink services and decentralized exchange infrastructure.

| Feature | Description | Benefits |

|---|---|---|

| Strategic Reserve | Accumulates LINK from offchain & onchain revenue | Ensures long-term network sustainability |

| Payment Abstraction | Converts user payments into LINK automatically | Reduces friction, simplifies payment processes |

| Security Timelock | Multi-day withdrawal delay | Adds protection for the reserve fund |

| Enterprise Integration | Revenue from large-scale clients | Strengthens adoption & funding growth |

Payment Abstraction: The Engine Behind the Reserve

Launched earlier this year, Payment Abstraction reduces friction by letting users pay in any supported asset. It now supports offchain revenue, including fees from enterprise clients and maintenance services, expanding its utility. Key technical components include:

- CCIP (Cross-Chain Interoperability Protocol): Consolidates fee tokens across multiple chains onto Ethereum.

- Automation: Initiates conversions without manual intervention.

- Price Feeds: Provides accurate token pricing to minimize transaction costs.

Initially integrated with Smart Value Recapture (SVR), Payment Abstraction is now a central driver of the Chainlink Reserve, automatically converting revenue streams into LINK.

Chainlink’s Competitive Advantage

Chainlink is widely recognized for its decentralized oracle network, which powers Chainlink Price Feeds. These feeds dominate the DeFi market, capturing 67.77% market share overall and 83.67% on Ethereum, securing over $80 billion in total value. Beyond DeFi, Chainlink’s modular and composable infrastructure enables cross-chain, multi-asset, and multi-system applications, integrating external data, legacy systems, and privacy solutions.

This unique platform positions Chainlink as a trusted connectivity layer for both public and private blockchains, making it indispensable for tokenized assets and enterprise-grade financial applications.

Revenue Streams Supporting the Reserve

The Chainlink Reserve is funded through multiple economic pillars:

- Enterprise Integrations: Revenue from large enterprises adopting Chainlink standards.

- Usage-Based Payments: Subscription or per-call fees for services like VRF, Automation, Functions, and CCIP.

- Revenue Sharing: Agreements with platforms such as GMX (1.2% of total fees) and Aave (35% of recaptured liquidation MEV).

- Build Program: Early-stage project support in exchange for future revenue allocations.

These revenue streams, combined with Payment Abstraction, form a self-reinforcing system that continuously grows the LINK reserve while supporting the network’s operational needs.

Cost Optimization and Sustainable Growth

Chainlink has also focused on operating cost reductions through initiatives like the Chainlink Runtime Environment (CRE), which modularizes oracle capabilities and streamlines infrastructure. Other cost-saving measures include node configuration optimization, deprecating redundant Data Feed DONs, and process streamlining.

The combination of cost efficiency and revenue growth ensures that the Chainlink Reserve contributes to a sustainable economic model, enabling adoption across DeFi, TradFi, and tokenized asset markets.

Transparency and Community Access

To maintain community trust, Chainlink has launched a dedicated analytics dashboard at reserve.chain.link and made the Reserve contract address publicly accessible on Etherscan. Users can monitor LINK accumulation, circulating supply, and other key metrics in real time, reinforcing the transparency and reliability of this economic initiative.

Also Read: Smart Contracts Explained: What They Are, How They Work, and Why They Matter

A Pivotal Step for Blockchain Infrastructure

The Chainlink Reserve represents a significant evolution in Chainlink Economics, combining Payment Abstraction, enterprise revenue, and sustainable growth initiatives. By automating the accumulation of LINK from diverse sources and reinforcing economic stability, Chainlink positions itself as the infrastructure standard for the mass adoption of tokenized assets and enterprise blockchain applications.

With this strategic Reserve, transparent monitoring, and ongoing adoption by top financial institutions, Chainlink continues to strengthen its competitive edge and create a self-sustaining ecosystem poised for long-term growth.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of explainedcrypto.com. Before making any investment decisions, you should always conduct your own research. explainedcrypto.com is not responsible for any financial losses.